16 September 2024

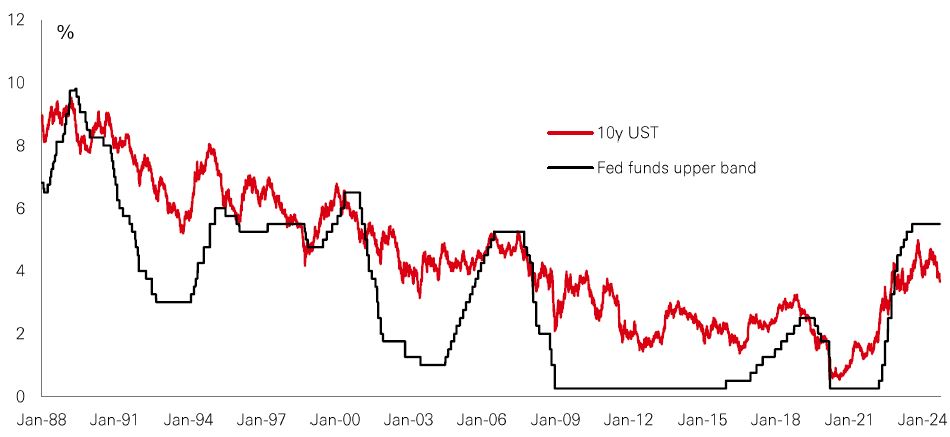

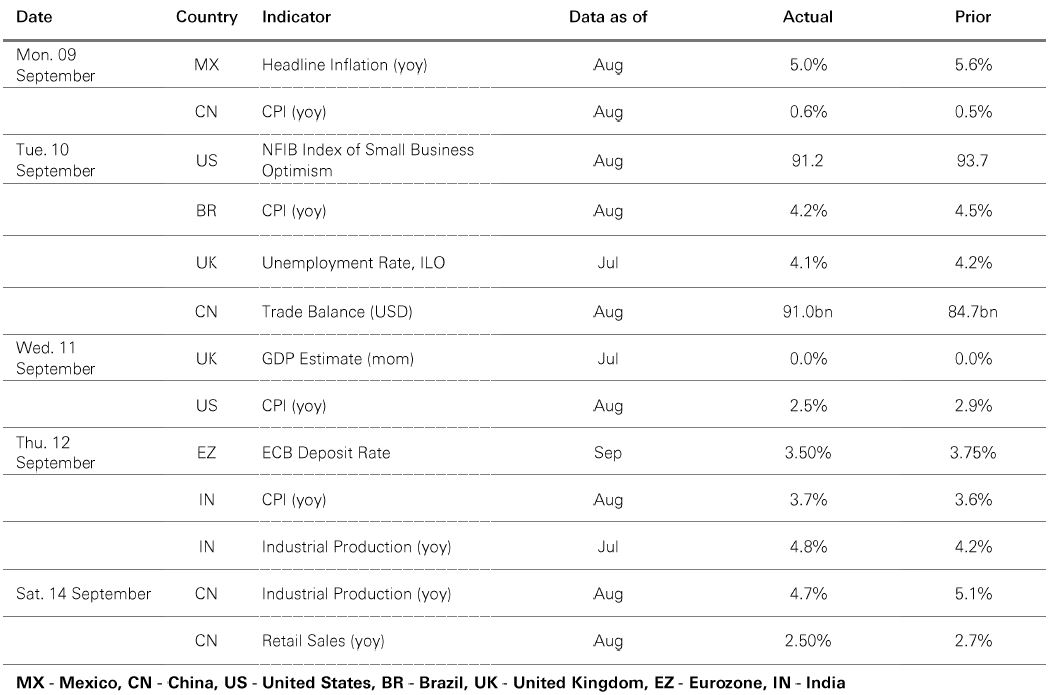

Markets are pricing in an approximate 40% chance of a 0.50% Fed cut on 18 September. This is despite an unexpectedly strong August core inflation print of 0.3% month-on-month. Shelter costs were the main culprit behind the upside surprise. Excluding shelter, core inflation is running at only 1.1% on a six-month annualised basis, suggesting that price pressures are under control and allowing the Fed to put more weight on the labour market leg of its mandate.

Here, the August data were mixed; unemployment ticked down, having jumped in July, but payrolls were softer than expected. Overall, a broad swathe of data suggests the labour market is continuing to cool, but relatively gradually, which helps explain why the overwhelming consensus among economists is for a 0.25% cut. However, the funds rate is at restrictive levels and, based on current market pricing, is only likely to return to a neutral stance around mid-2025.

Given policy acts with a lag, the risk that labour market cooling turns into labour market freezing will remain elevated for some time to come. This alone is likely to lead to further bouts of volatility in markets. And if those risks then crystallise, the Fed will be forced to cut aggressively. So, while Treasury yields have fallen markedly of late, they can still play an important role in hedging portfolios against downside growth scenarios.

Since the 16 July peak of the S&P 500, there has been a significant rotation in performance within the global equity space. Previous winners such as US tech have been lagging, while unloved regions and sectors – value, defensives, EM, and small caps – have taken the lead. For developed markets, this reversal of fortune for UK equities has been particularly striking.

Some analysts think as part of the wider broadening-out story, UK stocks can continue to be a relative winner. The market remains unloved and cheap, with the MSCI UK trading at a significant valuation discount versus its own 10-year average 12m forward PE. The UK market is also defensive, with significant weights in consumer staples and healthcare that can better withstand a deterioration in global economic conditions. And although a stronger pound might be a headwind to export-oriented firms – especially in the large-cap space – this can be offset by cheaper input costs from abroad. With EPS growth expected to jump into double-digits for 2025, the overall profits picture also looks good.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future.

This information shouldn't be considered as a recommendation to buy or sell specific sector/stocks mentioned. Any views expressed were held at the time of preparation and are subject to change without notice. While any forecast, projection or target where provided is indicative only and not guaranteed in any way. Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 11.00am UK time 13 September 2024.

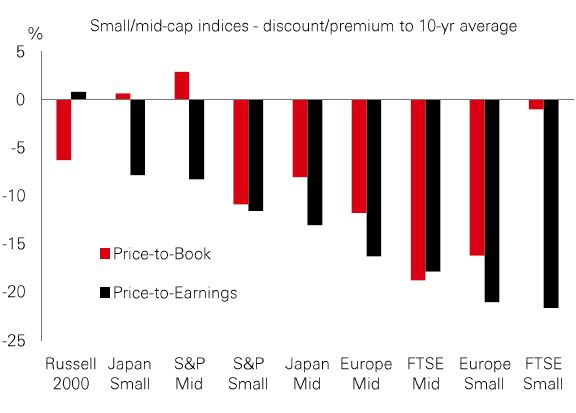

When volatility hit global stocks in August, and mega-cap tech firms sold off sharply, small-caps proved to be a surprise winner. And while the rally in smaller firms has since cooled, it gave us an insight into how quickly small cap value can react to steady growth and the prospect of rate cuts.

Currently, there are deep valuation discounts between smaller caps and large caps (and their own history). Most developed market indices show small- and mid-cap stocks trading 10-25% below their 10-year average measures like price/earnings (PE) and price/book. By contrast, the S&P 500 currently trades at a 30% premium to its 10-year average 12m forward PE. Selection is key.

Europe and Japan look particularly unloved, with the former expecting rate cuts and the latter an eventual return to inflation, boosting nominal profit growth.

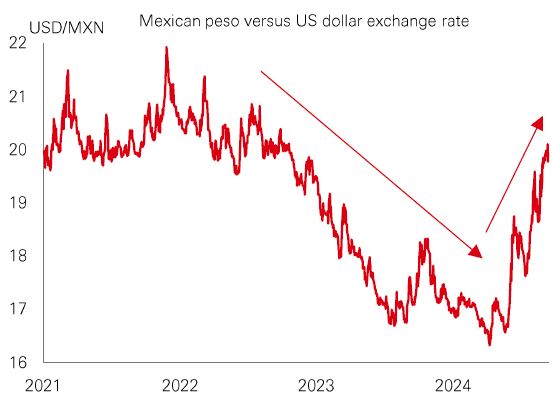

The Mexican peso has been one of the strongest performing EM currencies in recent years. This has come on the back of proactive central bank policy, a solid fiscal position, and strong economic ties with the outperforming US economy. Other more structural factors such as continuing growth in remittances and supply chain ‘nearshoring’ have also played a role.

Against a backdrop of elevated interest rate differentials, the peso has also seen interest from international investors engaging in ‘carry trades’ (where traders borrow in low rate currencies and buy higher rate assets). But this summer’s rapid unwinding of popular carry trades has put significant pressure on the currency, just as factors like domestic politics and the imminent US election have pushed uncertainty higher.

After the recent retreat, it now seems likely the so-called super peso may settle in a new range. Happy Independence Day to our Mexican readers!

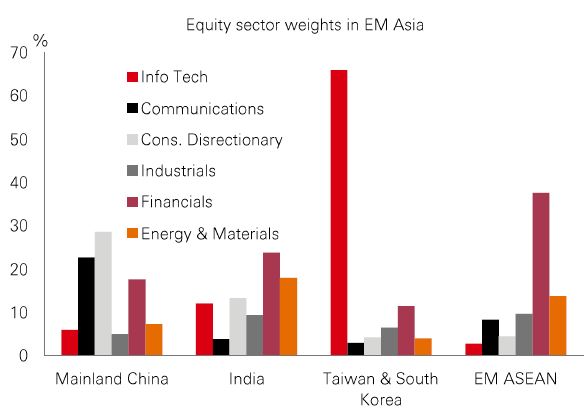

While global technology stocks have suffered badly in recent bouts of market volatility, analysts are upbeat on the sector in emerging Asia. Profit growth expectations have recently picked up on solid international demand for semiconductors and positive profits figures from mainland Chinese tech heavyweights.

But a catch for the region’s tech players is a potential slowdown in global growth. While firms in markets like Taiwan and South Korea have enjoyed years of strong demand, recent sector weakness has revealed some vulnerability to external headwinds and downside growth risks in the US.

The good news for investors is that while tech is expected to remain a profit engine for the region, emerging Asian markets also offer broad sector diversification. Against a backdrop of uncertain global growth, domestically-focused markets like mainland China, India, and ASEAN – where tech has a relatively small overall sector weighting – are less reliant on external demand.

Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. This information shouldn't be considered as a recommendation to buy or sell specific sector/stocks mentioned. Any views expressed were held at the time of preparation and are subject to change without notice. Source: HSBC Asset Management. Macrobond, Bloomberg, Datastream. Data as at 11.00am UK time 13 September 2024.

Source: HSBC Asset Management. Data as at 11.00am UK time 16 September 2024. This information shouldn't be considered as a recommendation to buy or sell specific sector/stocks mentioned. Any views expressed were held at the time of preparation and are subject to change without notice.

Risk markets rebounded ahead of the US Fed’s FOMC meeting this week, with rising expectations of a possible 0.50% cut. Core government bonds rallied, with US Treasuries faring better than German Bunds. The European Central Bank delivered a 0.25% cut in the deposit rate, with ECB president Lagarde reiterating that future cuts would remain “data dependent”. The US dollar DXY index fell to a 2024 low. US equities saw a broad-based rally, led by tech stocks, with the Euro Stoxx 50 and Japan’s Nikkei 225 also on course to finish the week higher. In emerging markets, the tech-dominant South Korea Kospi index posted modest gains and India’s Sensex index resumed its upward trend. Ongoing disinflation worries pushed China’s Shanghai Composite index close to 2024 lows. In commodities, oil prices stabilised late last week, after falling sharply on supply concerns. Gold reached fresh historic highs.

This document has been issued by The Hongkong and Shanghai Banking Corporation Limited (the "Bank") in the conduct of its regulated business in Hong Kong and may be distributed in other jurisdictions where its distribution is lawful. It is not intended for anyone other than the recipient. The contents of this document may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. This document must not be distributed to the United States, Canada or Australia or to any other jurisdiction where its distribution is unlawful. All non-authorised reproduction or use of this document will be the responsibility of the user and may lead to legal proceedings.

This document has no contractual value and is not and should not be construed as an offer or the solicitation of an offer or a recommendation for the purchase or sale of any investment or subscribe for, or to participate in, any services. The Bank is not recommending or soliciting any action based on it.

The information stated and/or opinion(s) expressed in this document are provided by HSBC Global Asset Management Limited. We do not undertake any obligation to issue any further publications to you or update the contents of this document and such contents are subject to changes at any time without notice. They are expressed solely as general market information and/or commentary for general information purposes only and do not constitute investment advice or recommendation to buy or sell investments or guarantee of returns. The Bank has not been involved in the preparation of such information and opinion. The Bank makes no guarantee, representation or warranty and accepts no responsibility for the accuracy and/or completeness of the information and/or opinions contained in this document, including any third party information obtained from sources it believes to be reliable but which has not been independently verified. In no event will the Bank or HSBC Group be liable for any damages, losses or liabilities including without limitation, direct or indirect, special, incidental, consequential damages, losses or liabilities, in connection with your use of this document or your reliance on or use or inability to use the information contained in this document.

In case you have individual portfolios managed by HSBC Global Asset Management Limited, the views expressed in this document may not necessarily indicate current portfolios' composition. Individual portfolios managed by HSBC Global Asset Management Limited primarily reflect individual clients' objectives, risk preferences, time horizon, and market liquidity.

The information contained within this document has not been reviewed in the light of your personal circumstances. Please note that this information is neither intended to aid in decision making for legal, financial or other consulting questions, nor should it be the basis of any investment or other decisions. You should carefully consider whether any investment views and investment products are appropriate in view of your investment experience, objectives, financial resources and relevant circumstances. The investment decision is yours but you should not invest in any product unless the intermediary who sells it to you has explained to you that the product is suitable for you having regard to your financial situation, investment experience and investment objectives. The relevant product offering documents should be read for further details.

Some of the statements contained in this document may be considered forward-looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Such statements do not represent any one investment and are used for illustration purpose only. Customers are reminded that there can be no assurance that economic conditions described herein will remain in the future. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. We can give no assurance that those expectations reflected in those forward-looking statements will prove to have been correct or come to fruition, and you are cautioned not to place undue reliance on such statements. We do not undertake any obligation to update the forward-looking statements contained herein, whether as a result of new information, future events or otherwise, or to update the reasons why actual results could differ from those projected in the forward-looking statements.

Investment involves risk. It is important to note that the capital value of investments and the income from them may go down as well as up and may become valueless and investors may not get back the amount originally invested. Past performance contained in this document is not a reliable indicator of future performance whilst any forecasts, projections and simulations contained herein should not be relied upon as an indication of future results. Past performance information may be out of date. For up-to-date information, please contact your Relationship Manager.

Investment in any market may be extremely volatile and subject to sudden fluctuations of varying magnitude due to a wide range of direct and indirect influences. Such characteristics can lead to considerable losses being incurred by those exposed to such markets. If an investment is withdrawn or terminated early, it may not return the full amount invested. In addition to the normal risks associated with investing, international investments may involve risk of capital loss from unfavourable fluctuations in currency values, from differences in generally accepted accounting principles or from economic or political instability in certain jurisdictions. Narrowly focused investments and smaller companies typically exhibit higher volatility. There is no guarantee of positive trading performance. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Economies in emerging markets generally are heavily dependent upon international trade and, accordingly, have been and may continue to be affected adversely by trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures imposed or negotiated by the countries with which they trade. These economies also have been and may continue to be affected adversely by economic conditions in the countries in which they trade. Mutual fund investments are subject to market risks. You should read all scheme related documents carefully.

Copyright © The Hongkong and Shanghai Banking Corporation Limited 2024. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of The Hongkong and Shanghai Banking Corporation Limited.

Issued by The Hongkong and Shanghai Banking Corporation Limited