2 December 2024

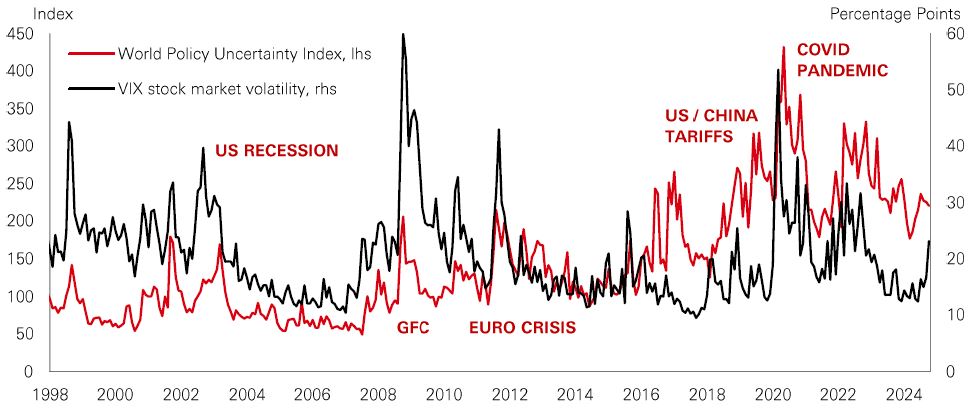

Rising uncertainty over economic and trade policy has been hanging over global markets in recent weeks. It’s the kind of anxiety that typically goes hand-in-hand with higher stock market volatility. So far, most of the volatility has been in rates markets. And that’s hardly surprising given uncertainty over the inflation outlook, particularly in a year when bond pricing has been hyper-sensitive to macro data.

Meanwhile, US stocks remain in a strong uptrend. But with market multiples pricing perfection (the S&P 500 hit another new high last week), bond yields still elevated, and growth cooling into 2025 – can calm conditions last?

In a “multi-polar world” of economic fragmentation and competing trade blocs, the most significant consequence for investors is a higher and more unpredictable inflation regime. This could constrain central bank policy easing, weighing on growth and corporate profits. Fixed income returns may still depend on yield income to support returns, and government bonds may not be a dependable hedge for portfolios. With geopolitics potentially disrupting underlying investor assumptions on the growth, profits, and inflation outlook, market volatility could easily pick up, should the global news flow deteriorate - and the most expensive parts of the market could be vulnerable.

Private credit has been a popular portfolio diversifier with investors in recent years – helped by an era of elevated rates that enhanced returns. But with central banks pivoting in the second half of 2024, a shift to lower rates has raised questions about whether that will change.

Yet, demand for private credit has remained robust. One explanation is that, while rates are on their way down, they are unlikely to fall to the very low levels experienced during the last decade. If rates begin to normalise at around 3%, it should leave room for private credit assets to deliver still-attractive all-in yields – particularly when compared to fixed-rate bonds. In fact, private credit premiums could potentially deliver a cushion as floating-rate yields decline. Another attraction is that private credit doesn’t rely on an exit market to fund the distributions given that loans are repaid after a fixed period. This has been an important differentiator to private equity markets, where a weaker exit environment recently has led to lower distributions back to investors.

Despite recent growth, private credit only accounts for around 6% of corporate lending in the US – which is one of the most mature private credit markets.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and not guaranteed in any way. Diversification does not ensure a profit or protect against loss.

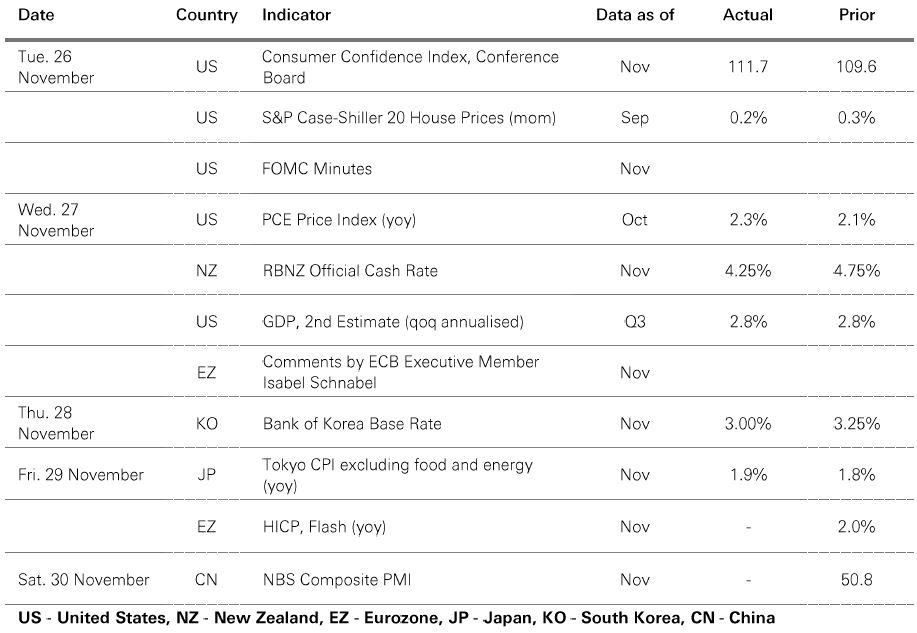

Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 7.30am UK time 29 November 2024.

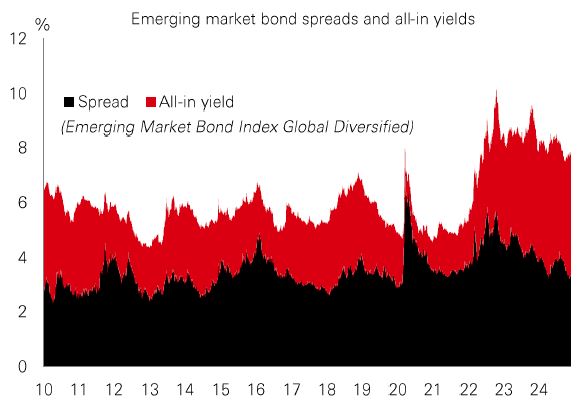

Investor sentiment towards emerging markets (EM) has been cautious in the wake of US elections and growing concerns about tariffs. EM sovereign bonds (tracked by the EMBI index), for instance, are a high-duration asset class with a structurally improving average credit-rating outlook. If bond yields gradually grind lower globally, EM sovereigns could be well-placed to perform given their historically high all-in yields. Spreads have compressed but are expected to remain well-behaved, thanks to a structural improvement in credit quality.

That said, global risks remain high, which could impact the asset class. Worries about inflation and more active fiscal policy mean markets are pricing a shallower path for US monetary easing. And tariffs are unlikely to leave many EMs unscathed, with risks of a strong US dollar tightening global financial conditions. For EM investors, country sensitivity to these headwinds will depend on factors like existing free trade agreements, relationships with the new US administration, and the degree of trade exposure that they have to the US.

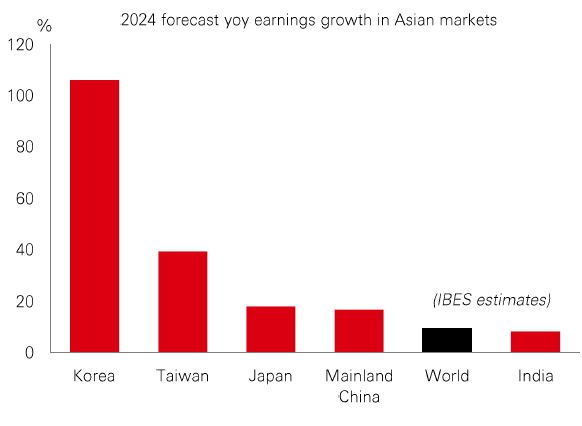

Asian stock markets have delivered decent performances this year, with mainland China and India setting the pace. But as Asia’s Q3 earnings season rolls on, we’ve seen regional variations in terms of sector winners and losers.

Technology-led markets in South Korea and Taiwan are still the region’s profit engine. Strong demand in industries like semiconductors and hardware has been potent, particularly in South Korea, which has seen a strong rebound in profits growth. In Japan, Q3 has also been solid, with financial stocks the big driver on improving margins. But its discretionary stocks have lagged, with profits falling among automakers. In mainland China, financial stocks (particularly insurance firms) have underpinned robust Q3 profits growth, and firms in hardware and e-commerce have been strong too.

By contrast, profits in India have surprised to the downside. But weak macro momentum in the quarter is expected to recover, and sectors like financials, healthcare, and real estate have performed well. Overall, some specialists continue to see fair valuations across the region, as well as solid growth and appealing economic diversification.

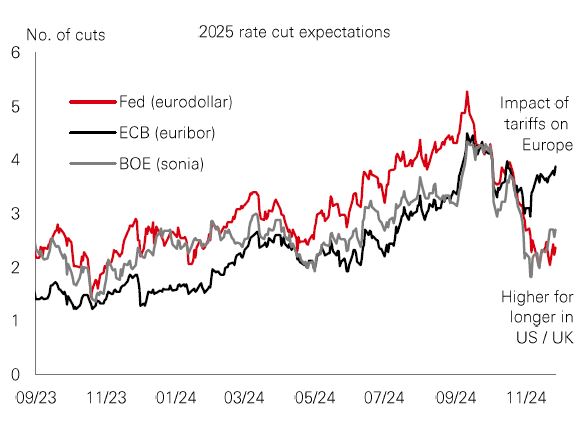

In addition to concerns about potential changes to US trade policy next year, the Eurozone is already dealing with its own fair share of problems – much of which are weighing on the euro.

Growth has weakened again, with manufacturing PMIs in France and Germany in the low 40s and services failing to do enough to produce positive growth. Then there is political uncertainty, with general elections in Germany in February and ongoing instability in France.

These risks have led to a sharp repricing in the relative outlooks for growth and monetary policy. Markets have priced in more aggressive monetary easing by the ECB, just as Fed rate cuts have been priced out.

The result is the euro has weakened in the face of a strengthening US dollar – and the next few months could be challenging.

The good news is a weaker euro supports domestic exporters, despite near-term caution on the profits outlook. Likewise, ECB rate cuts should boost both the macro outlook and government bonds.

Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice. Index returns assume reinvestment of all distributions and do not reflect fees or expenses. You cannot invest directly in an index. Any forecast, projection or target where provided is indicative only and not guaranteed in any way. Source: HSBC Asset Management. Macrobond, Bloomberg, Datastream. Data as at 7.30am UK time 29 November 2024.

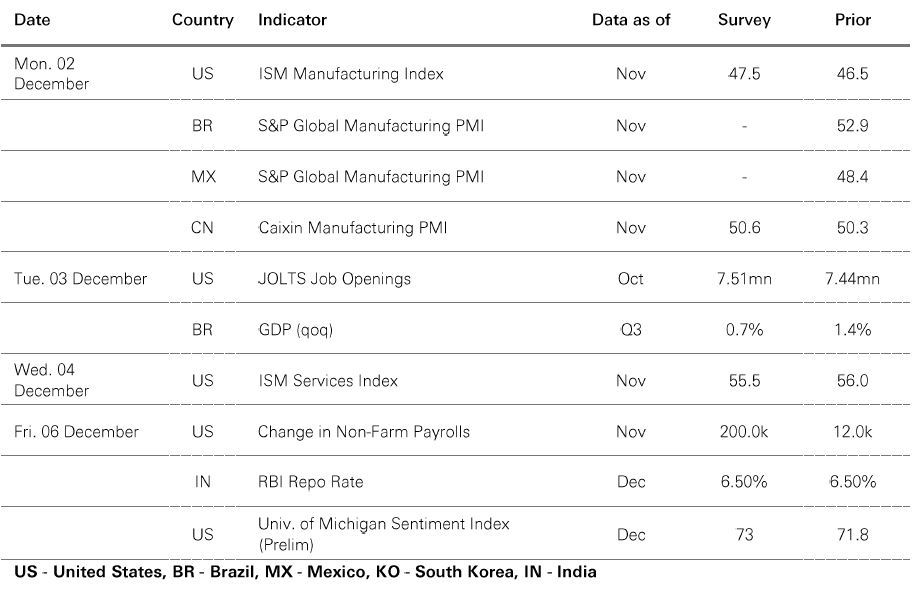

Source: HSBC Asset Management. Data as at 7.30am UK time 02 December 2024. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice.

Risk markets were stable, with the US dollar index correcting lower amid rising trade tensions. Core government bonds rallied as investors digested the latest appointments to the forthcoming US administration. Rising budget concerns prompted a wider 10yr yield spread between French and German government bonds. US equities posted modest gains in a holiday-shortened week, whereas the Euro Stoxx 50 index softened, led by a weakness in French stocks. Japan’s Nikkei 225 reversed earlier gains last week as the yen rebounded versus the US dollar. Emerging market equity performance was mixed. China’s Shanghai Composite and India’s Sensex advanced, while Korea’s Kospi index dropped on lingering worries over domestic macro outlook and geopolitical risks as the BoK delivered a surprise rate cut. In commodities, oil and gold consolidated. Copper edged higher.

This document has been issued by The Hongkong and Shanghai Banking Corporation Limited (the "Bank") in the conduct of its regulated business in Hong Kong and may be distributed in other jurisdictions where its distribution is lawful. It is not intended for anyone other than the recipient. The contents of this document may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. This document must not be distributed to the United States, Canada or Australia or to any other jurisdiction where its distribution is unlawful. All non-authorised reproduction or use of this document will be the responsibility of the user and may lead to legal proceedings.

This document has no contractual value and is not and should not be construed as an offer or the solicitation of an offer or a recommendation for the purchase or sale of any investment or subscribe for, or to participate in, any services. The Bank is not recommending or soliciting any action based on it.

The information stated and/or opinion(s) expressed in this document are provided by HSBC Global Asset Management Limited. We do not undertake any obligation to issue any further publications to you or update the contents of this document and such contents are subject to changes at any time without notice. They are expressed solely as general market information and/or commentary for general information purposes only and do not constitute investment advice or recommendation to buy or sell investments or guarantee of returns. The Bank has not been involved in the preparation of such information and opinion. The Bank makes no guarantee, representation or warranty and accepts no responsibility for the accuracy and/or completeness of the information and/or opinions contained in this document, including any third party information obtained from sources it believes to be reliable but which has not been independently verified. In no event will the Bank or HSBC Group be liable for any damages, losses or liabilities including without limitation, direct or indirect, special, incidental, consequential damages, losses or liabilities, in connection with your use of this document or your reliance on or use or inability to use the information contained in this document.

In case you have individual portfolios managed by HSBC Global Asset Management Limited, the views expressed in this document may not necessarily indicate current portfolios' composition. Individual portfolios managed by HSBC Global Asset Management Limited primarily reflect individual clients' objectives, risk preferences, time horizon, and market liquidity.

The information contained within this document has not been reviewed in the light of your personal circumstances. Please note that this information is neither intended to aid in decision making for legal, financial or other consulting questions, nor should it be the basis of any investment or other decisions. You should carefully consider whether any investment views and investment products are appropriate in view of your investment experience, objectives, financial resources and relevant circumstances. The investment decision is yours but you should not invest in any product unless the intermediary who sells it to you has explained to you that the product is suitable for you having regard to your financial situation, investment experience and investment objectives. The relevant product offering documents should be read for further details.

Some of the statements contained in this document may be considered forward-looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Such statements do not represent any one investment and are used for illustration purpose only. Customers are reminded that there can be no assurance that economic conditions described herein will remain in the future. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. We can give no assurance that those expectations reflected in those forward-looking statements will prove to have been correct or come to fruition, and you are cautioned not to place undue reliance on such statements. We do not undertake any obligation to update the forward-looking statements contained herein, whether as a result of new information, future events or otherwise, or to update the reasons why actual results could differ from those projected in the forward-looking statements.

Investment involves risk. It is important to note that the capital value of investments and the income from them may go down as well as up and may become valueless and investors may not get back the amount originally invested. Past performance contained in this document is not a reliable indicator of future performance whilst any forecasts, projections and simulations contained herein should not be relied upon as an indication of future results. Past performance information may be out of date. For up-to-date information, please contact your Relationship Manager.

Investment in any market may be extremely volatile and subject to sudden fluctuations of varying magnitude due to a wide range of direct and indirect influences. Such characteristics can lead to considerable losses being incurred by those exposed to such markets. If an investment is withdrawn or terminated early, it may not return the full amount invested. In addition to the normal risks associated with investing, international investments may involve risk of capital loss from unfavourable fluctuations in currency values, from differences in generally accepted accounting principles or from economic or political instability in certain jurisdictions. Narrowly focused investments and smaller companies typically exhibit higher volatility. There is no guarantee of positive trading performance. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Economies in emerging markets generally are heavily dependent upon international trade and, accordingly, have been and may continue to be affected adversely by trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures imposed or negotiated by the countries with which they trade. These economies also have been and may continue to be affected adversely by economic conditions in the countries in which they trade. Mutual fund investments are subject to market risks. You should read all scheme related documents carefully.

Copyright © The Hongkong and Shanghai Banking Corporation Limited 2024. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of The Hongkong and Shanghai Banking Corporation Limited.

Issued by The Hongkong and Shanghai Banking Corporation Limited