23 December 2024

Indonesia continues to chug along at its customary pace, with little impact from global trade tensions expected, while a new president may ultimately inject renewed vitality. Thailand is among the few who will see growth pick up, helped by fiscal spending and more tourists. The Philippines, too, more insulated than others from global trade friction, is heading back up, while in Malaysia may things cool at the margin as investment suffers from tariff uncertainty. Next door, Singapore will closely monitor the impact of trade tensions on its economy, while services continue to provide support. A nudge down in growth is also expected in Vietnam, though that still leaves it on top in ASEAN.

Source: Refinitiv Eikon, HSBC

Prabowo Subianto took over as Indonesia’s new president in October. Finance Minister Sri Mulyani’s reappointment came as a positive surprise to markets. All eyes are now on the key policies the new government champions. Prabowo has spoken at length about continuing his predecessor’s reforms – embarking on down-streaming 2.0, and continuing the infrastructure build-out. However, we believe there will be challenges along the way: for instance, lowering Indonesia’s carbon footprint, and restructuring certain state-owned enterprises (SOEs).

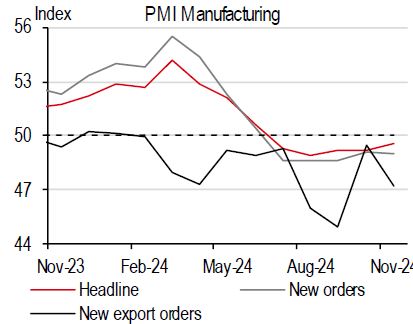

Meanwhile, growth has been on a weak footing. The PMI has been in contraction for five straight months, and GDP is only 7% above the pre-pandemic trend. In fact, the 3Q GDP growth print softened to 4.9% y-o-y. The details were telling. It was mainly government spending that drove investment. The latter is growing faster than consumption. Industry grew at a faster pace than services. Manufacturing appears to be climbing up the metals value chain, albeit rather gradually.

Indonesia wants to raise potential GDP growth as a policy priority. We believe that fiscal and monetary policy stimulus may not be sufficient. Breaking away from commodity price swings by raising geographically-diversified and higher value-added exports could bring large gains. Some good things have happened in recent years: Indonesia has gained market share in global exports, it has a trade surplus with the US, and a falling trade deficit with mainland China. Yet, these haven’t been able to lift domestic growth, because about half of the exports are commodity-linked with few backward linkages. And almost all of the exports to its biggest trade partner, mainland China, comprise of commodity-intensive products.

And yet, there are encouraging nascent signs of export diversification. Indonesia’s exports to the US look very different, in fact a lot like Vietnam’s export mix, comprising a lot more in terms of apparel, footwear, electrical machinery, and furniture. Vehicle exports to ASEAN are rising, as are electronics exports to the US and LatAm. But these are still rather small (for instance, just 9% of Indonesia’s exports go to the US) and need to be scaled up. Is that doable against an increasingly challenging global backdrop of rising trade protectionism? It will not be easy, but it is not impossible either. Indonesia doesn’t run a formidable trade surplus with the US, which could arguably protect it from large tariff increases. It could even benefit from supply chains getting rejigged in response to new tariffs on key exporters. And what will make it all happen? Indonesia will have to work hard on several fronts − enhancing infrastructure development, expanding trade agreements, developing a skilled workforce, and streamlining business practices.

Source: CEIC, HSBC

Source: CEIC, HSBC

Malaysia’s recovery story continues strongly in 2024. After growing at a stellar rate of 5.1% y-o-y in 1H24, the economy accelerated to 5.3% y-o-y in 3Q24. But more importantly, growth has been “on fire” across all sectors.

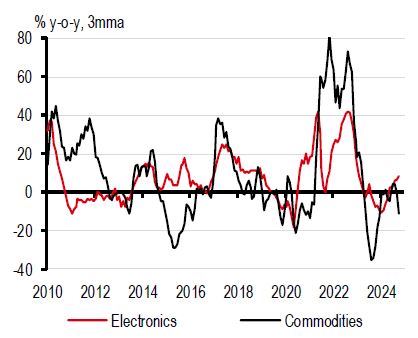

For one, Malaysia’s manufacturing sector continues to strengthen. However, it is a mixed picture when viewed by products. Electrical & electronics (E&E) exports have seen a decent rebound, benefitting from an improvement in global consumer electronics. Compared to peers, there is still room for Malaysia’s trade sector to improve, although that’s not the case for the commodity side. Palm oil continues to register double-digit growth, but oil and LNG exports remain drags on exports.

All eyes are now on US trade policies after Trump’s successful re-election as US president. Many of his proposed policy measures could hit global trade, but there is still a great deal of uncertainty. Malaysia’s sizeable trade surplus with the US may attract unwanted attention, and its prominent semiconductor sector may be among the areas that are vulnerable to tariff risks. Despite external risks, consumption and investment can, fortunately, partially support growth. What stands out is the impressive growth in gross fixed capital formation (GFCF), which expanded by double-digits for three consecutive quarters, where strength came from both the public and private sides.

Given the strong momentum, we recently upgraded our GDP growth for 2024 to 5.2% (from 5.0%), closer to the upper-end of the government’s forecast range of 4.8-5.3%. Meanwhile, we also upgraded our 2025 growth forecast to 4.8% (from 4.6%).

Outside of growth, inflation remains largely benign. Headline inflation averaged around 1.8% y-o-y in the first ten months of the year. Given recent downside surprises, we recently revised our headline inflation forecast down to 1.9% (from 2.3%) for 2024 and to 2.7% (from 3%) for 2025, although we acknowledge uncertainty from the potential subsidy rationalisation on RON95. We believe Bank Negara Malaysia (BNM) will keep its policy rate unchanged at 3%, a view we have held for a long time. That being said, the possibility of a rate hike, from potential upside risks to inflation, is likely to be higher than a rate cut; however, neither is our base case.

Source: CEIC, HSBC

Source: CEIC, HSBC

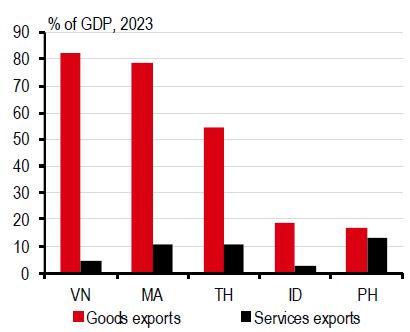

As global trade tensions loom, the Philippines is among the most insulated economies in ASEAN when it comes to tariff risks. For one, the archipelago is not known as a major exporter of goods; in 2023, the Philippines had the smallest export exposure in ASEAN at 16.8% of its GDP. But its insulation goes beyond its exposure in goods. The Philippines’ economic niche is in services exports. Not only is this an industry with minimal tariff risk, but artificial intelligence and digitalisation have made services more tradeable – giving the Philippines a window of opportunity to take-off and expand its global economic footprint.

But the Philippines isn’t completely insulated. The economy can be indirectly affected through monetary policy and FX. Its current account balance has been in deficit ever since the end of the pandemic due to the government’s ambitious infrastructure agenda. This makes the Philippines susceptible to exchange rate volatility if the Federal Reserve (Fed) were to decide to cut its easing cycle short and keep its monetary policy rate higher than expected. Such may be the case if the tariff policies in the US stoke inflation yet again.

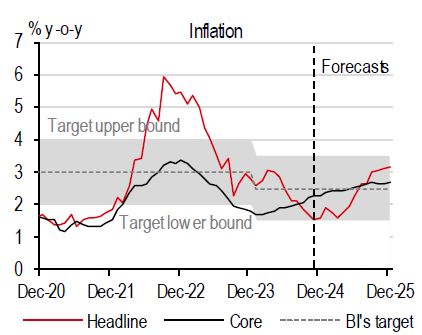

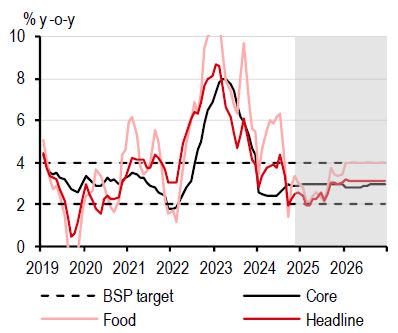

This, of course, complicates the Bangko Sentral ng Pilipinas’ (BSP) ongoing easing cycle. Domestic economic conditions already warrant further easing. Growth in 3Q24 surprised on the downside due to the super typhoons that plagued the archipelago over the past three months, such as Typhoon Yagi and Man-Yi. Furthermore, inflation has been benign, staying within the lower-end range of the BSP’s 2-4% target band. We expect inflation to remain within the lower-bound range throughout 2025 with low tariff rates on rice putting a lid on overall prices. This low inflation environment gives the BSP the impetus to continue its easing cycle.

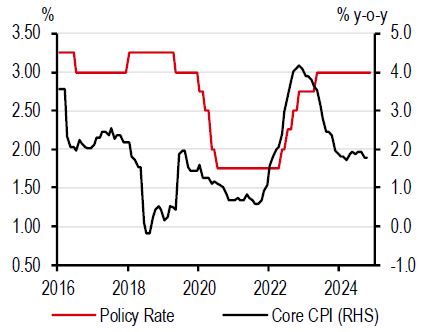

But the pace matters. The BSP is likely to be mindful of the Fed’s easing cycle to mitigate the volatility in the USD-PHP and stem the risk of FX-induced inflation. That being said, we recently changed our policy rate forecast and expect a slower and longer easing cycle but kept our end-rate forecast at 5.00%. Instead of cutting policy rates in consecutive rate-setting meetings, we now expect the BSP to clock in the same pace as the Fed by cutting in every other Monetary Board meeting. This implies that the BSP is likely to end its easing cycle in 3Q25 at 5.00%.

Source: CEIC, HSBC

Note: Shaded area represents HSBC forecasts.

Source: CEIC, HSBC

It is not every day a developed market (DM) sees growth over 5% y-o-y. Singapore did. After growing 3% y-o-y in 1H24, Singapore’s growth accelerated to 5.4% y-o-y in 3Q. This placed Singapore as the second fastest-growing economy in ASEAN in 3Q, just after Vietnam.

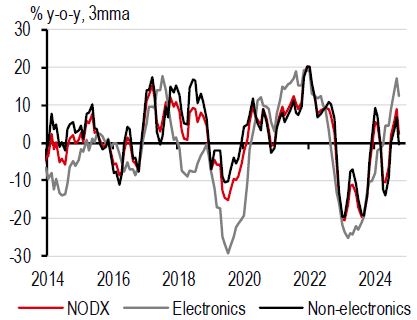

That being said, a deep-dive into the GDP breakdown is also important. Around 80% of 3Q’s growth strength was thanks to a substantial upswing in the overall manufacturing sector. After two quarters of declines, Singapore’s manufacturing has finally started to revive. More importantly, it is encouraging to see broad-based growth across major sub-sectors, particularly in semiconductors and pharmaceuticals, but some of them are volatile in nature.

Unlike the booming manufacturing sector, it is a rather mixed picture for services. While traderelated services have been benefitting from the trade upcycle and travel-related services continue to be resilient, some consumer-oriented sectors have softened. The labour market is also a crucial consideration when the Monetary Authority of Singapore (MAS) assesses the health of the overall economy. Fortunately, the labour market has remained resilient, albeit showing initial cooling signs. All in all, we recently upgraded our growth forecast to 3.7% (previously 3.0%) for 2024 and maintain our 2025 growth forecast at 2.6%

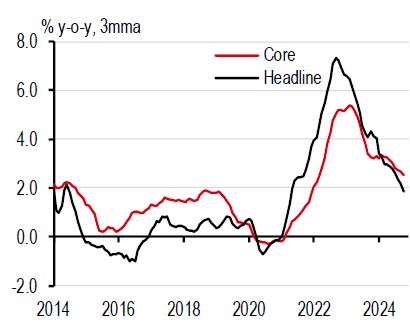

The good news does not stop at growth; inflation has also seen progress. Core inflation decelerated to 2.1% y-o-y in October, thanks to the broad-based cooling of price pressures. Services inflation was the biggest contributor, while fuel and utilities costs continued to edge down after electricity tariffs were adjusted downwards. As such, we recently revised down our core inflation forecast to 2.7% for 2024 (previously 2.8%), but keep our 2025 forecast unchanged at 1.9%.

Despite cooling inflation, we do not believe this will prompt the MAS to ease in January. In the October meeting, the MAS sounded less committed to its current monetary policy but made no commitment to a potential change of monetary policy in 2025 either. After all, there is still uncertainty as the market waits for more clarity on concreate policy in President-elect Trump’s second term.

Source: CEIC, HSBC

Source: CEIC, HSBC

Pistons are cranking and the engines are revving. For the Thai economy, that is.

After a weak recovery in 2023, 3Q24 growth in Thailand accelerated to 3.0%, which is the second consecutive quarter that growth surprised on the upside. Thailand’s export engine is finally up and running, growing 9.5% y-o-y on average over the past four months. Domestic demand in mainland China has picked up slightly while importers across the globe are frontloading their purchases to shield themselves from tariff risks. Thailand’s tourist arrivals also continued to improve. And, most importantly, the economy’s fiscal engines are finally revving after a dismal performance. The FY24 budget was only passed in April, which was six months into the fiscal year. As a result, the government backloaded all its spending in 3Q24, ending with the first phase of the Digital Wallet Scheme, a week before the fiscal year ended. On 25 September 2024, the government handed out THB10,000 in cash to 14.5 million low-income and disabled citizens – a stimulus that is likely to be felt in October. That being said, we expect growth in 4Q24 to accelerate to as high as 4.1% y-o-y.

But headwinds persist in 2025. Thailand’s household debt (which is the highest amongst uppermiddle income economies), stands at 89.6% of GDP, and is likely to be a major drag on private consumption. Manufacturing is also exhibiting signs of weakness with banks reluctant to provide credit for automobile purchases and with manufacturers facing tough competition from mainland China and ASEAN peers. Like Vietnam and Malaysia, the economy is also highly exposed to tariff risks given its dependence on trade and how important Chinese components are to Thai exports. If nothing is done, growth in 2025 could slow down to 2.5-3.0%.

But that is not what we expect. This is because policy uncertainty has finally abated with the FY25 budget passed. Here, THB186bn was earmarked for the second and third phases of the Digital Wallet Scheme. Although this is only a part of the THB300bn remaining for the scheme, the government is determined to implement the programme in full by the first half of the year (The Nation, 20 November 2024). We expect the fiscal push to bump full-year 2025 growth to as high as 3.3%.

However, we do not expect monetary policy to follow suit. With growth being lifted via fiscal levers, we expect the Bank of Thailand to keep its monetary stance steady at 2.25%.

Source: CEIC, HSBC

Source: CEIC, Macrobond. 2025 and 2026 deficits are HSBC forecasts.

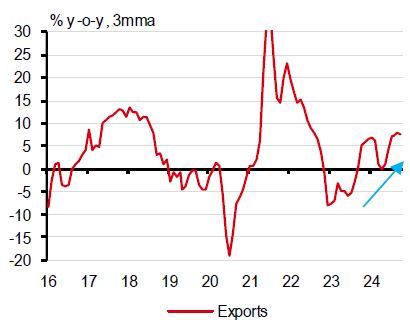

Vietnam continues to lead growth in ASEAN. Its growth saw a notable upside surprise in 3Q24, accelerating to 7.4% y-o-y from 6.4% in 1H24. Despite facing challenges from Typhoon Yagi in September – the strongest storm Vietnam has faced in 70 years – growth remains strong thanks to robust trade performance.

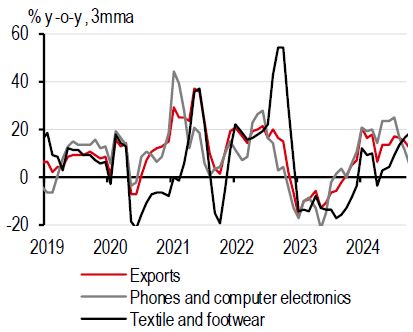

What is more encouraging is the breadth of the trade recovery. Albeit starting with consumer electronics, other major shipments, including textile and footwear, machinery, and agriculture products, have all seen stellar growth. Despite uncertainties in the outlook for global trade, a healthy momentum in export growth is expected to continue over the near term.

However, a notable uplift in the domestic sector has not occurred yet. Cognizant of the relatively subdued domestic momentum, the government has approved another extension of the 2% value-added tax (VAT) cut to June 2025, originally set to expire at the end of 2024. That being said, domestic conditions are improving, albeit gradually. Real estate sentiment and credit growth continue to recover, while the increase in manufacturing activity is expected to eventually filter through to the job market and household income with greater intensity.

We forecast GDP growth of 7.0% for 2024 and 6.5% for 2025. That being said, we are mindful of the trade headwinds from potential tariff policies from the US. The National Assembly has set a GDP growth target of 6.5-7% for 2025, but recently Prime Minister Pham Minh Chinh said the government will strive for growth of c8% (Bloomberg, 2 December 2024).

Outside of growth, inflation remains comfortably under the State Bank of Vietnam’s (SBV) 4.5% target ceiling as underlying price pressures remain subdued. The recent moderation in global energy prices have also been favourable for Vietnam. We expect inflation to remain benign through our forecast horizon, and we kept our inflation forecasts at 3.6% for 2024 and 3.0% for 2025, respectively. However, currency developments will require close monitoring, with our expectations that the SBV will remain prudent and hold its policy rate throughout 2025.

Source: CEIC, HSBC

Note: ASEAN4 = Malaysia, Philippines, Singapore, and Thailand. *2024 is as of September.

Source: CEIC, HSBC

Additional disclosures

1. This report is dated as at 20 December 2024.

2. All market data included in this report are dated as at close 19 December 2024, unless a different date and/or a specific time of day is indicated in the report.

3. HSBC has procedures in place to identify and manage any potential conflicts of interest that arise in connection with its Research business. HSBC's analysts and its other staff who are involved in the preparation and dissemination of Research operate and have a management reporting line independent of HSBC's Investment Banking business. Information Barrier procedures are in place between the Investment Banking, Principal Trading, and Research businesses to ensure that any confidential and/or price sensitive information is handled in an appropriate manner.

4. You are not permitted to use, for reference, any data in this document for the purpose of (i) determining the interest payable, or other sums due, under loan agreements or under other financial contracts or instruments, (ii) determining the price at which a financial instrument may be bought or sold or traded or redeemed, or the value of a financial instrument, and/or (iii) measuring the performance of a financial instrument or of an investment fund.

This document is prepared by The Hongkong and Shanghai Banking Corporation Limited (‘HBAP’), 1 Queen’s Road Central, Hong Kong. HBAP is incorporated in Hong Kong and is part of the HSBC Group. This document is distributed by HSBC Continental Europe, HBAP, HSBC Bank (Singapore) Limited, HSBC Bank (Taiwan) Limited, HSBC Bank Malaysia Berhad (198401015221 (127776-V))/HSBC Amanah Malaysia Berhad (200801006421 (807705-X)), The Hongkong and Shanghai Banking Corporation Limited, India (HSBC India), HSBC Bank Middle East Limited, HSBC UK Bank plc, HSBC Bank plc, Jersey Branch, and HSBC Bank plc, Guernsey Branch, HSBC Private Bank (Suisse) SA, HSBC Private Bank (Suisse) SA DIFC Branch, HSBC Private Bank Suisse SA, South Africa Representative Office, HSBC Financial Services (Lebanon) SAL, HSBC Private banking (Luxembourg) SA and The Hongkong and Shanghai Banking Corporation Limited (collectively, the “Distributors”) to their respective clients. This document is for general circulation and information purposes only. This document is not prepared with any particular customers or purposes in mind and does not take into account any investment objectives, financial situation or personal circumstances or needs of any particular customer. HBAP has prepared this document based on publicly available information at the time of preparation from sources it believes to be reliable but it has not independently verified such information. The contents of this document are subject to change without notice. HBAP and the Distributors are not responsible for any loss, damage or other consequences of any kind that you may incur or suffer as a result of, arising from or relating to your use of or reliance on this document. HBAP and the Distributors give no guarantee, representation or warranty as to the accuracy, timeliness or completeness of this document. This document is not investment advice or recommendation nor is it intended to sell investments or services or solicit purchases or subscriptions for them. You should not use or rely on this document in making any investment decision. HBAP and the Distributors are not responsible for such use or reliance by you. You should consult your professional advisor in your jurisdiction if you have any questions regarding the contents of this document. You should not reproduce or further distribute the contents of this document to any person or entity, whether in whole or in part, for any purpose. This document may not be distributed to any jurisdiction where its distribution is unlawful.

The following statement is only applicable to HSBC Bank (Taiwan) Limited with regard to how the publication is distributed to its customers: HSBC Bank (Taiwan) Limited (“the Bank”) shall fulfill the fiduciary duty act as a reasonable person once in exercising offering/conducting ordinary care in offering trust services/business. However, the Bank disclaims any guaranty on the management or operation performance of the trust business.

The following statement is only applicable to by HSBC Bank Australia with regard to how the publication is distributed to its customers: This document is distributed by HSBC Bank Australia Limited ABN 48 006 434 162, AFSL/ACL 232595 (HBAU). HBAP has a Sydney Branch ARBN 117 925 970 AFSL 301737.The statements contained in this document are general in nature and do not constitute investment research or a recommendation, or a statement of opinion (financial product advice) to buy or sell investments. This document has not taken into account your personal objectives, financial situation and needs. Because of that, before acting on the document you should consider its appropriateness to you, with regard to your objectives, financial situation, and needs.

Important Information about the Hongkong and Shanghai Banking Corporation Limited, India (“HSBC India”)

HSBC India is a branch of The Hongkong and Shanghai Banking Corporation Limited. HSBC India is a distributor of mutual funds and referrer of investment products from third party entities registered and regulated in India. HSBC India does not distribute investment products to those persons who are either the citizens or residents of United States of America (USA), Canada or New Zealand or any other jurisdiction where such distribution would be contrary to law or regulation.

Mainland China

In mainland China, this document is distributed by HSBC Bank (China) Company Limited (“HBCN”) and HSBC FinTech Services (Shanghai) Company Limited to its customers for general reference only. This document is not, and is not intended to be, for the purpose of providing securities and futures investment advisory services or financial information services, or promoting or selling any wealth management product. This document provides all content and information solely on an "as-is/as-available" basis. You SHOULD consult your own professional adviser if you have any questions regarding this document.

The material contained in this document is for general information purposes only and does not constitute investment research or advice or a recommendation to buy or sell investments. Some of the statements contained in this document may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. HSBC India does not undertake any obligation to update the forward-looking statements contained herein, or to update the reasons why actual results could differ from those projected in the forward-looking statements. Investments are subject to market risk, read all investment related documents carefully.

© Copyright 2025. The Hongkong and Shanghai Banking Corporation Limited, ALL RIGHTS RESERVED.

No part of this document may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior written permission of The Hongkong and Shanghai Banking Corporation Limited.

Important information on sustainable investing

“Sustainable investments” include investment approaches or instruments which consider environmental, social, governance and/o r other sustainability factors (collectively, “sustainability”) to varying degrees. Certain instruments we include within this category may be in the process of changing to deliver sustainability outcomes.

There is no guarantee that sustainable investments will produce returns similar to those which don’t consider these factors. Sustainable investments may diverge from traditional market benchmarks.

In addition, there is no standard definition of, or measurement criteria for sustainable investments, or the impact of sustainable investments (“sustainability impact”). Sustainable investment and sustainability impact measurement criteria are (a) highly subjective and (b) may vary significantly across and within sectors.

HSBC may rely on measurement criteria devised and/or reported by third party providers or issuers. HSBC does not always conduct its own specific due diligence in relation to measurement criteria. There is no guarantee: (a) that the nature of the sustainability impact or measurement criteria of an investment will be aligned with any particular investor’s sustainability goals; or (b) that the stated level or target level of sustainability impact will be achieved.

Sustainable investing is an evolving area and new regulations may come into effect which may affect how an investment is categorised or labelled. An investment which is considered to fulfil sustainable criteria today may not meet those criteria at some point in the future.