Invest in currency pairs as underlying assets

Awarded Singapore's Best for Investment Research, Euromoney Global Private Banking Award 2024*

HSBC is the preferred wealth partner for multigenerational families globally and we are committed to delivering high-quality insights and market analysis to help our clients make informed decisions.

*Singapore's Best Investment Research award is won by HSBC Global Private Banking.

How it works

- Invest a minimum of SGD 50,000

- Select your base and linked currencies from the currencies available on the Everyday Global Account

- Choose an investment term ranging between 1 week and 3 months

- Select a strike rate

- Get proceeds in either currency depending on the currency movement in the market at the end of the investment term

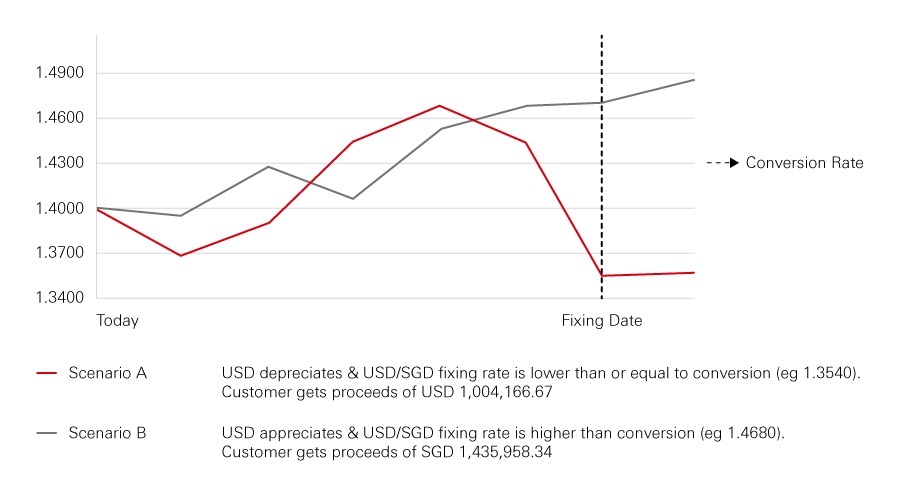

Suppose that you invest USD1,000,000 in Dual Currency Plus today with spot rate at 1.4000, selecting SGD as your linked currency, 1 month investment term with return of 5% per annum and strike/conversion rate of 1.4300. Your proceeds depends on the exchange rate on fixing day – in Scenario A, you will receive them in USD while in Scenario B, you will receive them in SGD.

Currencies available

You can link the Singapore dollar to any of these currencies:

- Australian dollar (AUD)

- Canadian dollar (CAD)

- Euro (EUR)

- Japanese yen (JPY)

- New Zealand dollar (NZD)

- Pound sterling (GBP)

- Swiss franc (CHF)

- US dollar (USD)

- Hong Kong dollar (HKD)

- Chinese yuan (offshore RMB) 1

1RMB-specific risks for RMB products

RMB is currently not freely convertible and RMB conversion may be subject to certain restrictions. The amount of offshore RMB (deliverable outside mainland China, informally known as CNH) may be limited, which may affect the liquidity of offshore RMB products. The market for offshore RMB is a different market to that of onshore RMB (deliverable in mainland China, known as CNY). Apart from its own supply and demand, the offshore RMB exchange rate may be influenced by the onshore exchange rate, which currently trades within a band set by authorities in the onshore interbank market. The two rates may converge with or diverge from each other.

Things to know

- Your Dual Currency Plus will be placed in your base currency at the beginning of your investment term

- Your proceeds will be paid on maturity date, while the outcome will be known on fixing day – which is 2 days before the maturity date

- If the linked currency you have selected weakens, your maturity proceeds may be less than what you originally invested. If the linked currency strengthens, your money will stay in your base currency.

- You must be a HSBC Premier customer

- Refer to the product sheet here.

Eligibility

You need to have the following:

- Aged 21 and above

- Have an Everyday Global Account

- Valid Customer Knowledge Assessment (CKA) where you have assessed to have knowledge and experience in investing in Dual Currency investments.

How to apply

If you'd like to invest in a Dual Currency Plus, you can speak with one of our wealth experts on the phone or in branch to determine your risk tolerance and your investment objectives.

Contact me

Leave us your contact details and our Wealth Manager will be in touch with you.

In person

Come and see us in a branch to set up your FX limit order.

Over the phone

Important Notes

Dual Currency Plus is an investment product. With Dual Currency Plus, the principal sum and returns are repayable, as determined conclusively by the Bank, either in the currency in which the investment is made ("base currency") or an alternative currency ("linked currency") at maturity. Early withdrawal of Dual Currency Plus, if permitted, will be subjected to the bank's procedures and applicable charges and you may incur a loss on your principal upon withdrawal.

The following terms and conditions apply to an investment in Dual Currency Plus: (i) the relevant Term Sheet; (ii) the Dual Currency Plus Terms and Conditions; and (iii) the Terms and Conditions governing HSBC Account User Agreement.

*Renminbi (RMB) is considered a convertible foreign exchange and the conversion of RMB through selected banks in Singapore is subject to certain restrictions. Local RMB products are denominated and settled in RMB which is also known as offshore RMB and is different from that of the RMB deliverable in mainland China.

Dual Currency Plus is classified as an unlisted Specified Investment Product (SIP). SIPs are derivatives or products which may contain derivatives. They are complex products and cannot generally be sold without advice. In particular, if you have limited knowledge on investment products, you are encouraged to seek advice from a financial adviser. If you choose not to seek advice from a financial adviser, you should carefully consider whether the investment is suitable. Any transaction you decide to make will be of your own choice and at your own risk.

Unlisted SIPs are those that are not listed on an exchange.

As your investment is denominated in a foreign currency, you are advised to consider the impact of any foreign exchange risk on the net returns of your investment. Foreign exchange controls may be imposed by the country/region issuing the foreign currency from time to time and may delay or prevent the payment of the proceeds to you.

You may be interested in

Everyday Global Account

Meet your transactional needs in up to 11 different currencies.

Worldwide Transfer Service

Make transferring funds to other banks outside of Singapore easy.

FX Order Watch

Set your own target FX rate to convert funds automatically.

Investments

See all our investment products.